Feature of the Bank

Shoko Chukin Bank

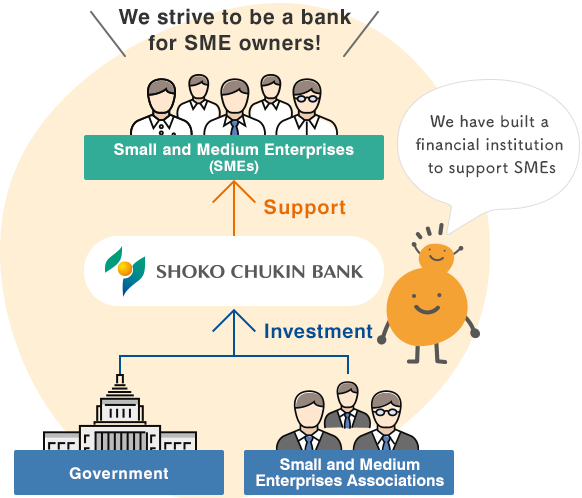

A financial institution run for the SMEs,

by the SMEs.

In the early Showa era, due to frequent crises, many businesses fell into critical condition. Shoko Chukin Bank was born out of such a burning desire of small and medium enterprises to get relief from this situation. In 1936, it was established through joint investments from government and associations acting as a financial institution to fund each company through business associations.

More than 80 years since its founding, as a financial institution specializing in small businesses, we continue to look towards a stable future for small businesses, regardless of if the economy if good or bad.

What services do we provide?

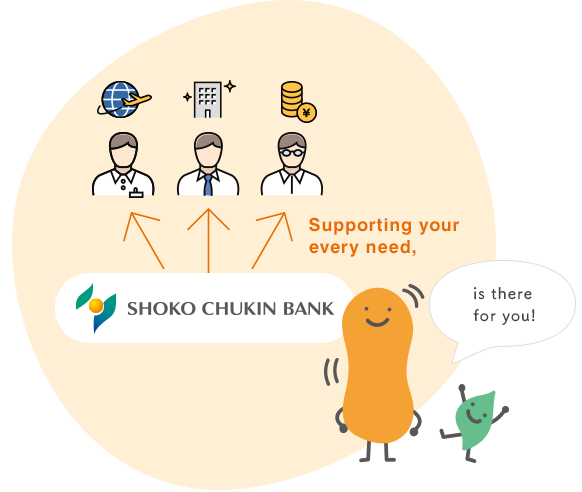

Made-to-order, customized solutions

to match the customer

Shoko Chukin Bank boasts small business finance know-how that has been cultivated over 80 years of experience. In addition to financial information, we provide made-to-order, customized services according to the life stage of the company while understanding management realities such as business and technology details and the skills and thoughts of managers. Along with long term and short term financing, we provide services to meet every need of the businesses such as finance improvements, business revitalization, management improvements, and overseas expansion.

What are our strengths?

Expansion throughout Japan and overseas

Our strength is our extensive network.

In order to earnestly face the challenges of each region, Shoko Chukin Bank has a branch network that extends throughout all 47 prefectures of Japan. Along with four overseas locations, we have a wide network of partnerships with various organizations, both domestic and abroad. We use this extensive network to provide a wide range of information to small businesses and to support business partnerships such as business matching and M&A.

What are other features of Shoko Chukin Bank?

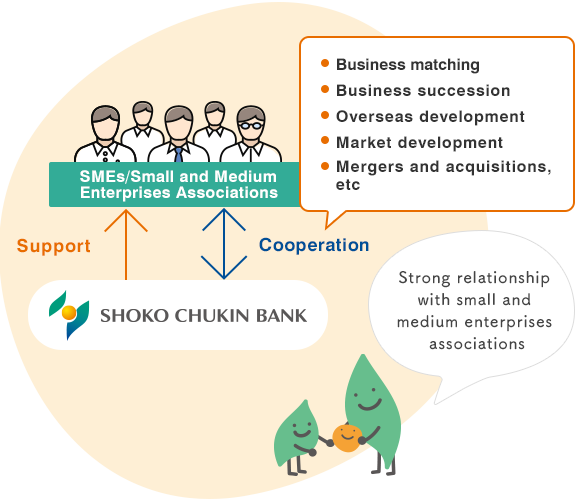

Through small and medium enterprises associations,

we offer various solutions.

Since Shoko Chukin Bank's founding through joint investments from government and associations, it has featured a strong relationship with small and medium enterprises associations. Through joint ventures, small business associations can improve productivity, support new businesses, and cooperate on a variety of issues that cannot be resolved by individual companies. Since its establishment in 1936, Shoko Chukin Bank has served to increase the value of small and medium enterprises associations and association member businesses by following association administration, providing information on subsidies, and through financing.

We will continue to provide various solutions through small and medium enterprises associations, facilitate business successions, and make efforts to support the funding needs of SME owners.

What is our cooperation status with other organizations?

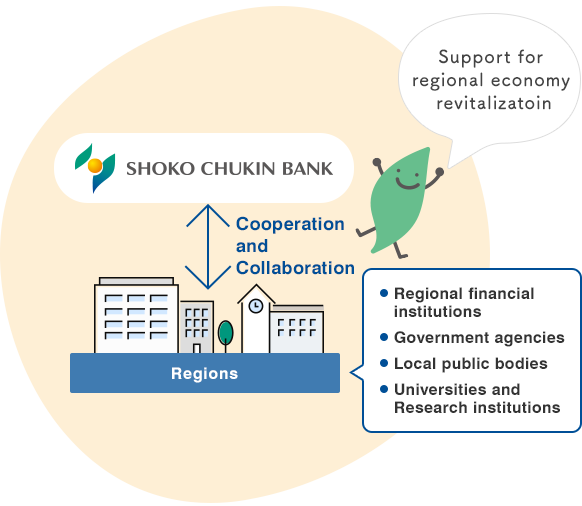

We promote cooperation and collaboration,

right from the level of regional financial institutions.

Shoko Chukin Bank regards regional financial institutions and their industry groups as "partners to cooperatively achieve regional financial facilitation and regional economy revitalization based on coexistence and mutual complementation in the region", by cooperatively working together as one on the foundation of business management. In 2018, we set up a new "regional cooperation promotion office" to further strengthen a relationship of mutual trust with each institution while making the best of the features of neutral public financial institutions, and strengthening our role as coordinators of cooperation between multiple support institutions.

We will continue to support the

growth and development of SMEs,

which play crucial role

in the Japanese economy.