Systems of Ensure Sound

Business Operations

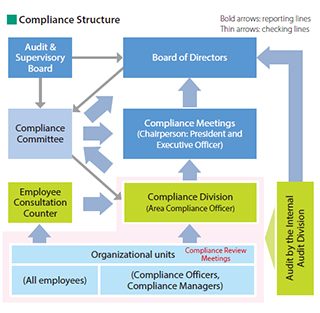

Compliance Systems

Ensuring full compliance is seen as a crucial aspect of the Bank's operations. In all its business operations and other activities, the Bank must comply with all accepted rules and social norms, use disclosure to fulfill its obligation of accountability, and maintain a high degree of transparency.

Thorough Awareness of the Importance of Compliance

The Shoko Chukin Bank has established the Code of Ethics as its basic policy on compliance. The Bank has established and distributed to officers and employees a Compliance Manual summarizing the Code of Ethics, the action standards for putting the Code in practice, and the laws and ordinances that must be observed in the pursuit of business activities. Furthermore, specific initiatives to raise compliance awareness include group training programs as well as regular branch-level training programs, in order to thoroughly ensure compliance.

Compliance Structure

Compliance Committee

Delegated by the Board of Directors, the Compliance Committee has been established as an organization to provide the Compliance Division/Departments with guidance and checks, and to provide advice regarding general matters concerning compliance.

Organizations Established to Deliberate on Matters Relating to Compliance

Matters relating to compliance are reported to and deliberated by the Compliance Meetings, which is chaired by President and Executive Officer. Results of the Compliance Meetings’ deliberations are reported to the Board of Directors. The Board of Directors makes decisions on important compliance matters such as compliance-oriented programs.

The Compliance Coordination Division

- (1)The Compliance Division has been designated as the organizational unit responsible for compliance-related planning and management. The Department works closely with other departments and divisions to establish and further develop the Bank’s compliance structure and systems.

- (2)In the Compliance Division, the Area Compliance Officer has been assigned to grasp the degree of understanding of compliance and give instructions on site.

Organizational units

Headquarters divisional managers and business office managers have been designated as compliance officers, and Headquarters and business office staff have been designated as compliance managers to ensure stringent compliance. In addition to conducting regular checks to ensure employees are not contravening laws or regulations, these compliance officers and managers provide guidance and training for employees as necessary. In cases where compliance managers from the Headquarters draw up or amend internal regulations, these amendments are examined to ensure that they comply with all laws, ordinances and rules and pose no problems from the viewpoint of social norms. Where necessary, outside specialists are consulted.

Compliance Inspections

Headquarters divisions and business offices are required to conduct self-assessments to ensure thoroughgoing compliance. The Internal Audit Division, which is independent of other Headquarters divisions, also conducts thorough compliance inspections of Headquarters divisions and business offices. The results of audits are reported at Internal Auditing Meetings or Management Meetings attended by Audit and Supervisory Board Members, and are then reported periodically at Board of Directors’ meetings.

Employee Consultation System

The Bank has set up the employee consultation system (internal alert system) to prevent further escalation and swiftly resolve any compliance problems that occur. The system has been set up so that both executives and employees can easily make reports, with consultation contacts established in the offices of external lawyers and external businesses as well as the Compliance Division.

Zero tolerance of Anti-social Forces

As a financial institution, to maintain public confidence and ensure the adequacy and soundness of our business activities, the Bank is required to eliminate anti-social forces from financial transactions.

The Shoko Chukin Bank develops its system aimed at the elimination of anti-social forces by taking initiatives such as designating the Compliance Division as a coordinating division and assigning a compliance officer associated with in each organizational unit, thereby working on to cut off the relationships and eliminate transactions with anti-social forces, in cooperation with external professional bodies including the police and lawyers.