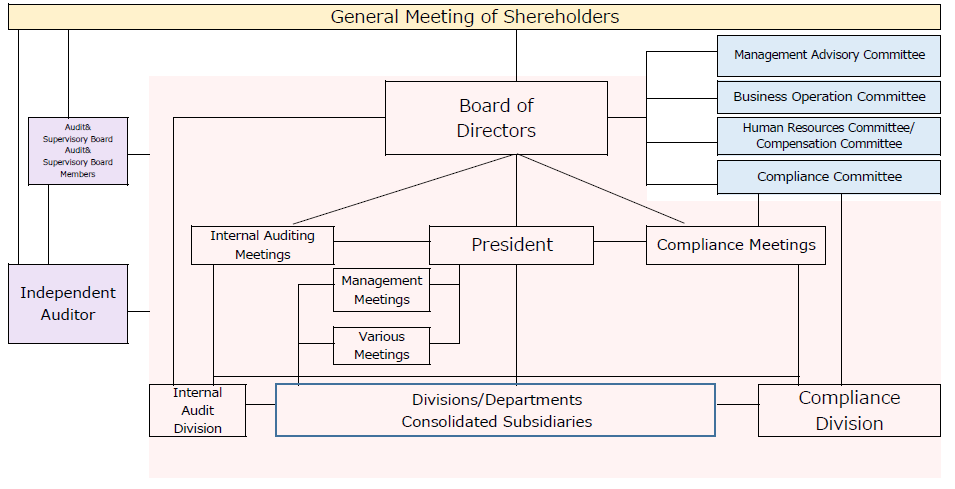

The Shoko Chukin Bank's Governance System

Systems of Ensure Sound Business Operations

The change in status from that of a government-affiliated financial institution to a special company (a joint-stock company established pursuant to a special act) provides an opportunity for the Shoko Chukin Bank to reinforce and further upgrade its corporate governance structure and systems. At the same time, the Bank is well positioned to maintain its basic role as a financial institution run for SMEs by SMEs under the governance of its shareholders - SME cooperatives and their members - the government, market and relevant laws including the Shoko Chukin Bank Limited and Companies acts. In this context, the Bank will establish boards of directors and Audit & Supervisory Board Member and appoint an independent auditor. The Bank will also establish the Management Advisory Committee made up of select representatives from SME loan recipient companies to ensure that the opinions and voice of its core client base are accurately reflected in the Bank's management, Human Resources Committee made up of representatives from SME loan recipient companies and knowledgeable outside individuals to ensure that the opinions and advices of SMEs regarding the executive appointment are accurately reflected in the Bank's management, Compensation Committee made up of representatives from SME loan recipient companies and knowledgeable outside individuals to ensure that the opinions and advices of SMEs regarding the directors' compensation and retirement benefits are accurately reflected in the Bank's management, and Business Operation Committee to ensure that the advices concerning the status to ensure appropriate competitive relations with other operators and the principle of diverse collaboration and cooperation with regional financial institutions are reflected in the Bank's management.

- Management Advisory Committee

- To ensure that the opinions and voice of its core client base are accurately reflected in the Bank's management, a management advisory committee has been established comprising select representatives from SME loan recipient companies. The Management Advisory Committee provides comments and advice on the Bank's operating activities.

- Business Operation Committee

- In order to ensure that the advices regarding the review of status to ensure appropriate competitive relations with other operators and the principle of diverse collaboration and cooperation with regional financial institutions is reflected in the Bank's management, the Business Operation Committee has been established.

- Human Resources Committee

- Human Resources Committee comprising representatives from SME loan recipient companies and knowledgeable outside individuals, has been established to seek comments and advice in respect of directors appointment.

- Compensation Committee

- The Compensation Committee comprising representatives from SME loan recipient companies and knowledgeable outside individuals, has been established to voice opinions and provide advice on the evaluation of performance with respect to directors' compensation and retirement benefits.

Governance Chart

Risk Management Structure

Under the Bank's market risk management structure, market operations are separated into front office and back office departments. In addition, a middle office fulfills a specialist role in managing market risk, with the overall structure providing a system of checks and balances between each of the functions.

The middle office monitors operations on a daily basis to ensure strict compliance with the market risk and liquidity risk limits set after deliberation by the Management Meetings and ALM Meetings. The results of these monitoring activities are reported on a regular basis.

Crisis Management System

The Bank established the "BCP Basic Guidelines" to set forth responsive measures to be taken by the Shoko Chukin Bank and all of its officers and employees with respect to disaster prevention as well as a system ensuring the smooth operation of business activities by restoring its functions immediately upon the occurrence of disasters so as to minimize management risk associated with the suspension of business.