New Appearance of Shoko Chukin Bank

Shoko Chukin Bank Management Reform Plan (Medium-term Management Plan)

As a plan to implement the "Shoko Chukin Bank Management Reform Plan", which was submitted to the competent ministry on May 22, 2018, Shoko Chukin Bank formulated and publicly announced the "Shoko Chukin Bank Management Reform Plan" on October 18 of the same year.

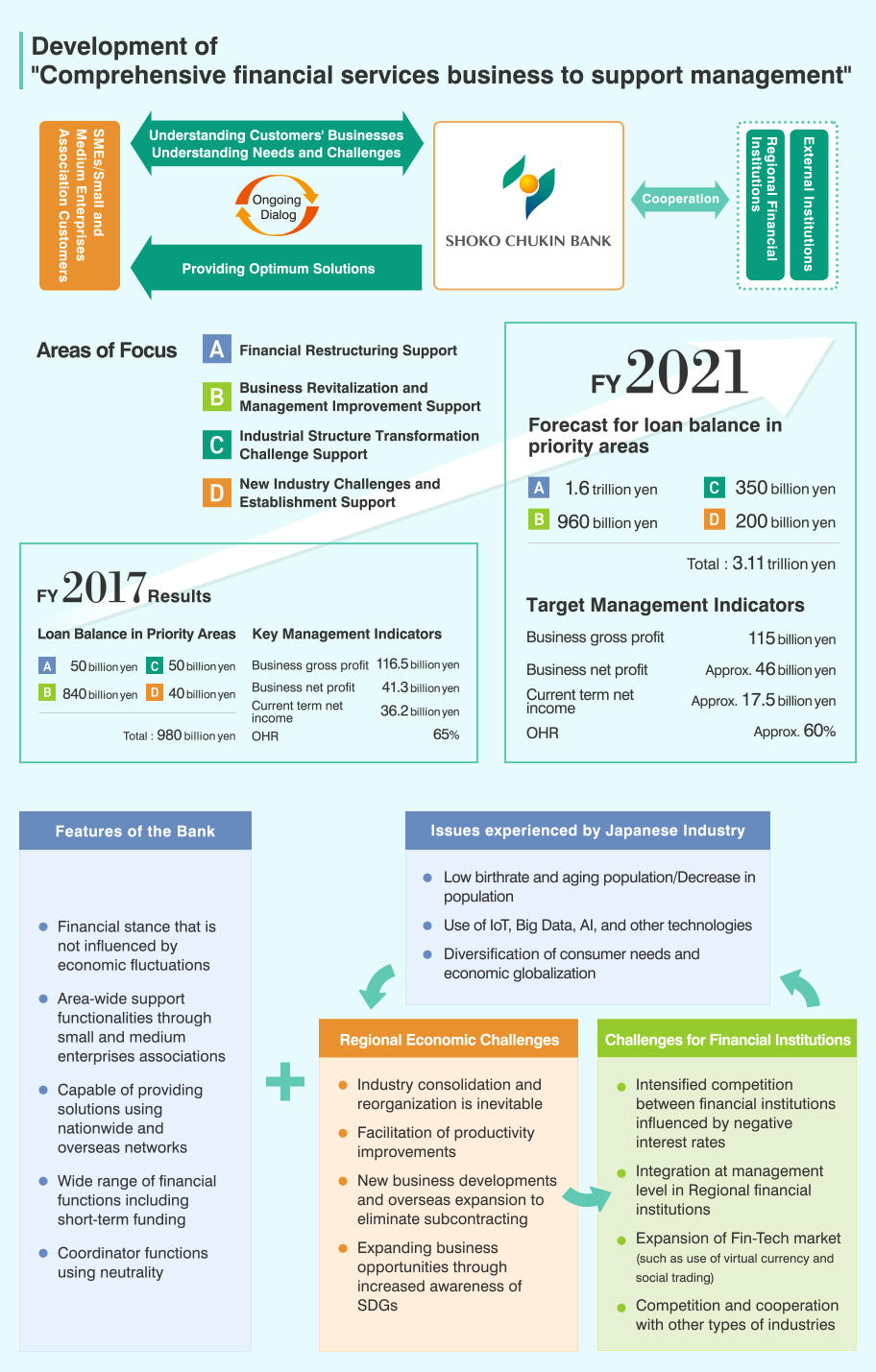

Along with this plan, Shoko Chukin Bank is developing the "Comprehensive financial services business to support management", providing improved value to SMEs and small and medium enterprises associations from a truly long-term, customer-oriented perspective.

Measures and Support regarding Management Issues Faced by SMEs

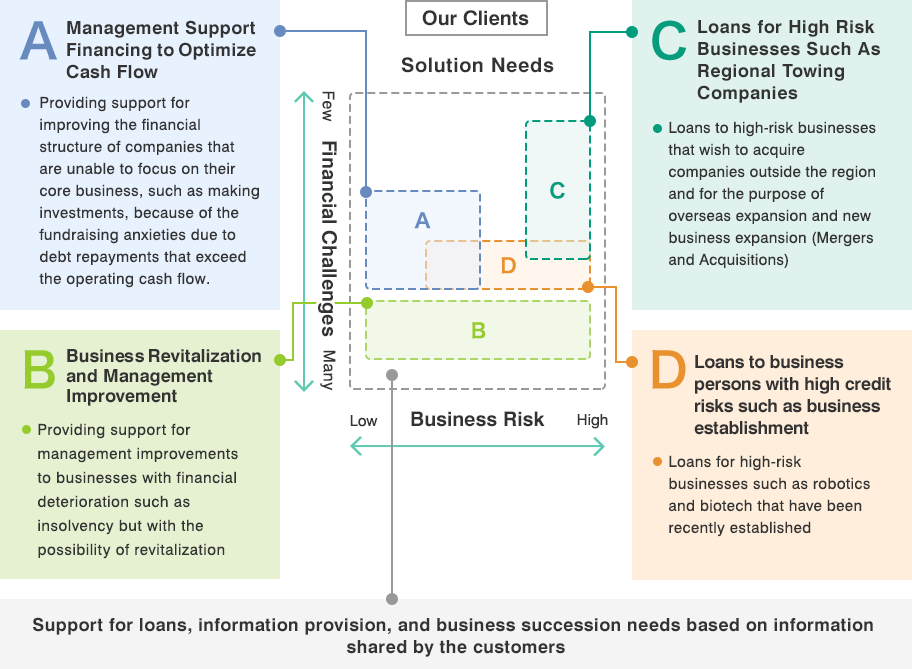

For SMEs with low productivity who are in need of management reform, business revitalization, and business succession as well as SMEs which are unskillfully advancing high-risk ventures, based on the challenges faced by the customers, we cooperate and collaborate with regional financial institutions to provide solutions to help our customers solve their problems while focusing on the following areas:

Initiatives in four areas of focus

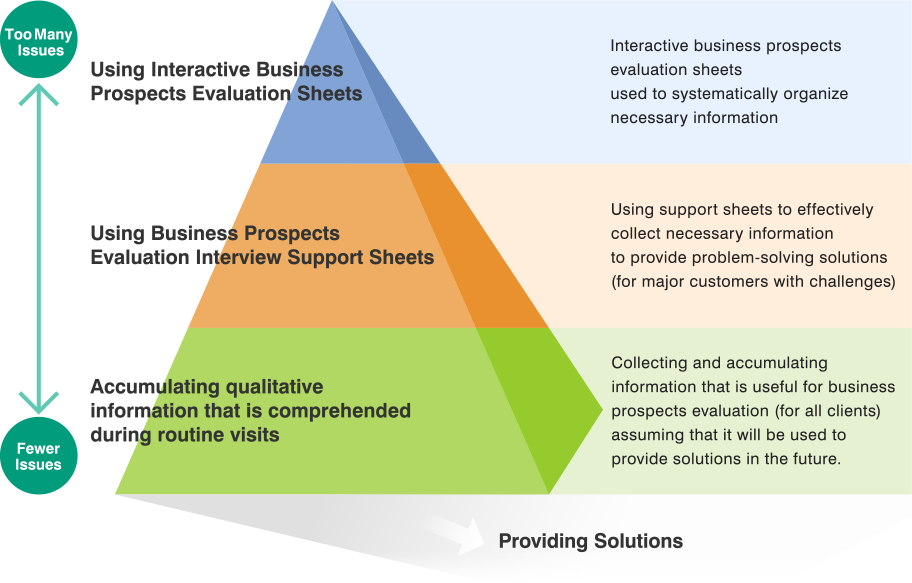

Shoko Chukin Bank has positioned its business prospects evaluation as a starting point for its comprehensive financial services business to support management. In order to deepen the relationship of mutual trust with customers, understand the businesses and grasp the potential for future growth, we conduct interviews based on the situation and understand sales channels, and utilize the systematically accumulated information to make judgments when determining credit limits or providing solutions.

Business Prospects Evaluation

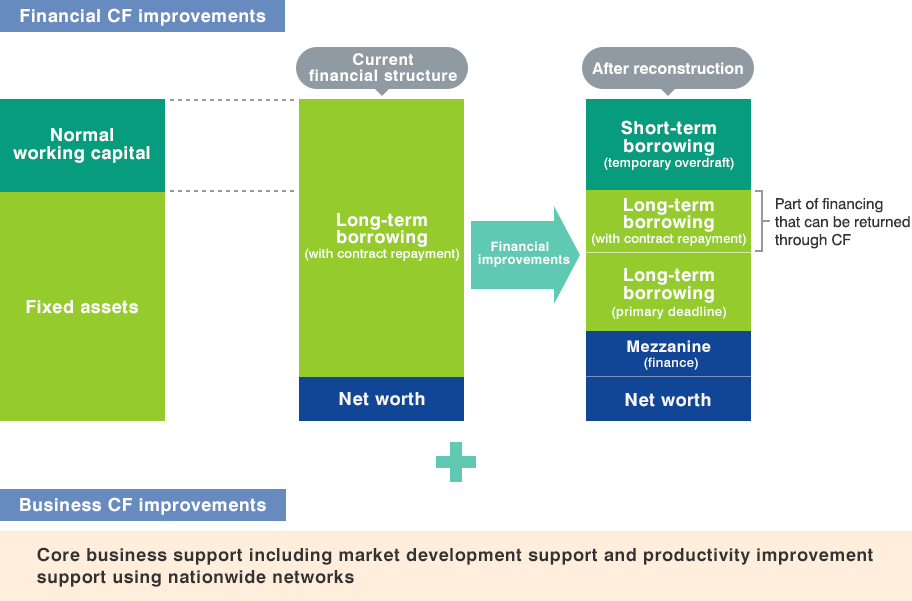

Via business prospects evaluations, we precisely comprehend customers' challenges, and based on their needs, refinance leading to drastic solutions, and improve financial CF through temporary overdrafts according to working capital requests and long-term bullet repayment financing, as well as deal with core business support leading to the improvement of business CF through business matching.

Structure to Facilitate the Business Model

Establishing a Sustainable Financing Process

- Supply channel reconstruction based on changes in customer needs.

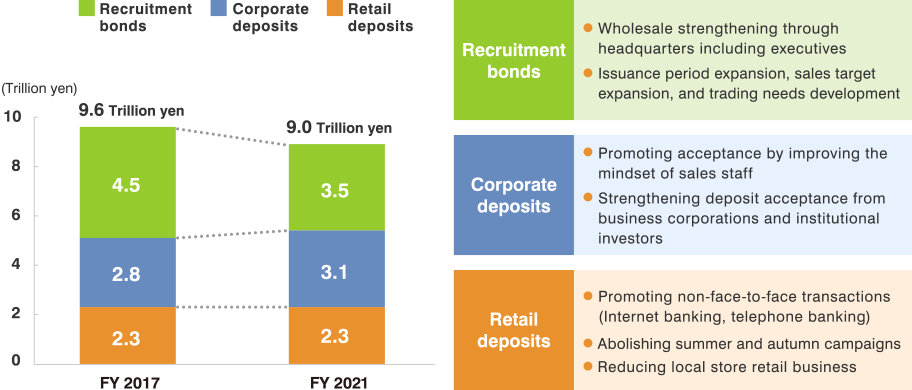

- Securing the necessary procurement by using the three pillars of recruitment bonds, corporate deposits, and retail deposits.

- Recruitment bonds declined from 4.5 trillion yen to 3.5 trillion yen.

- Due to corporate deposits accumulation, the procurement balance for FY 2021 is secured at 9 trillion yen.

Streamlining Management

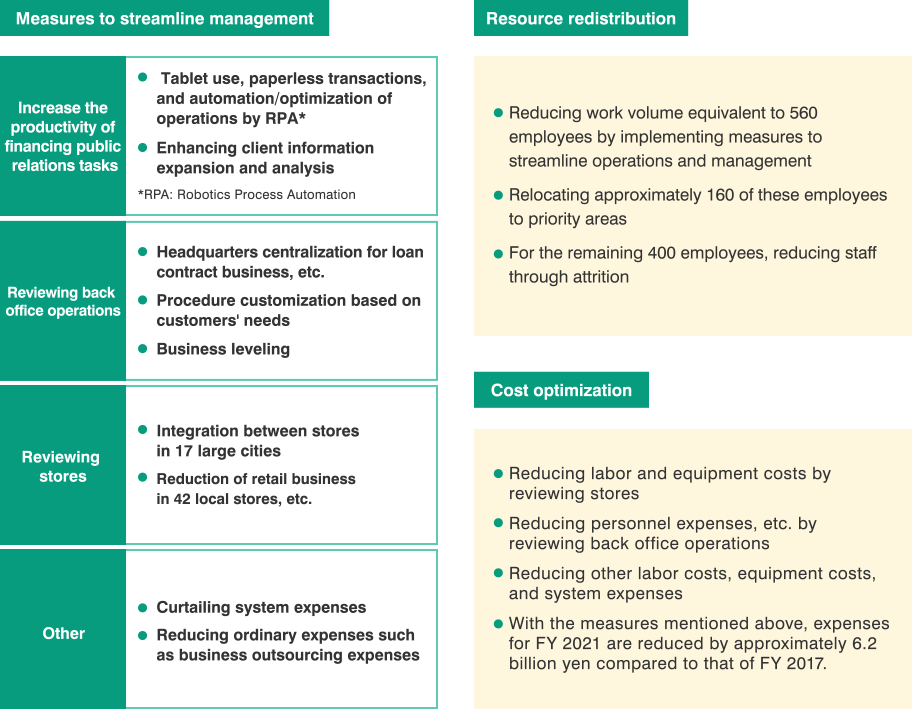

- While maintaining nationwide networks, we plan to redistribute resources to areas of focus and optimize costs.

- In order to streamline operations and management, thoroughly and quickly, we established a full-time cross-sectional team.

Condition Maintenance

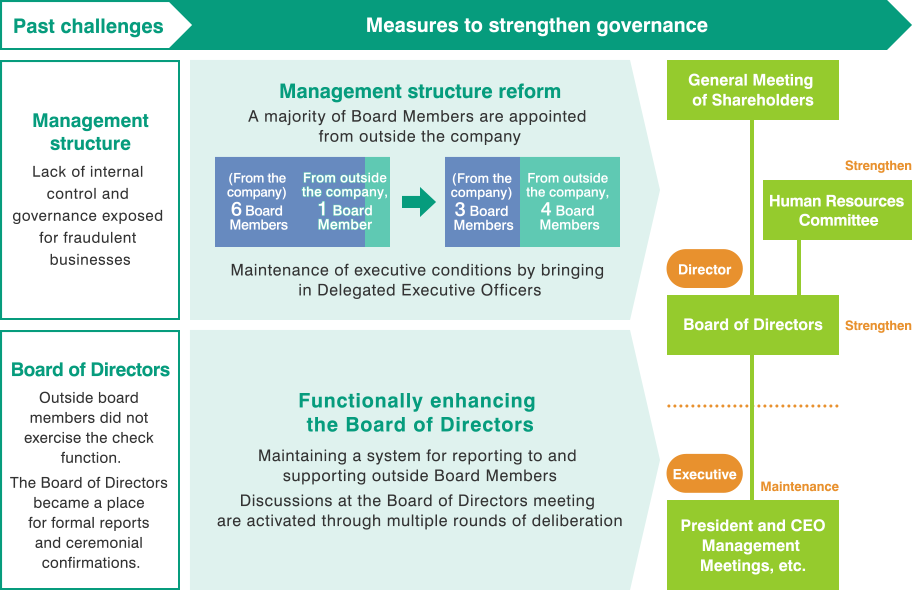

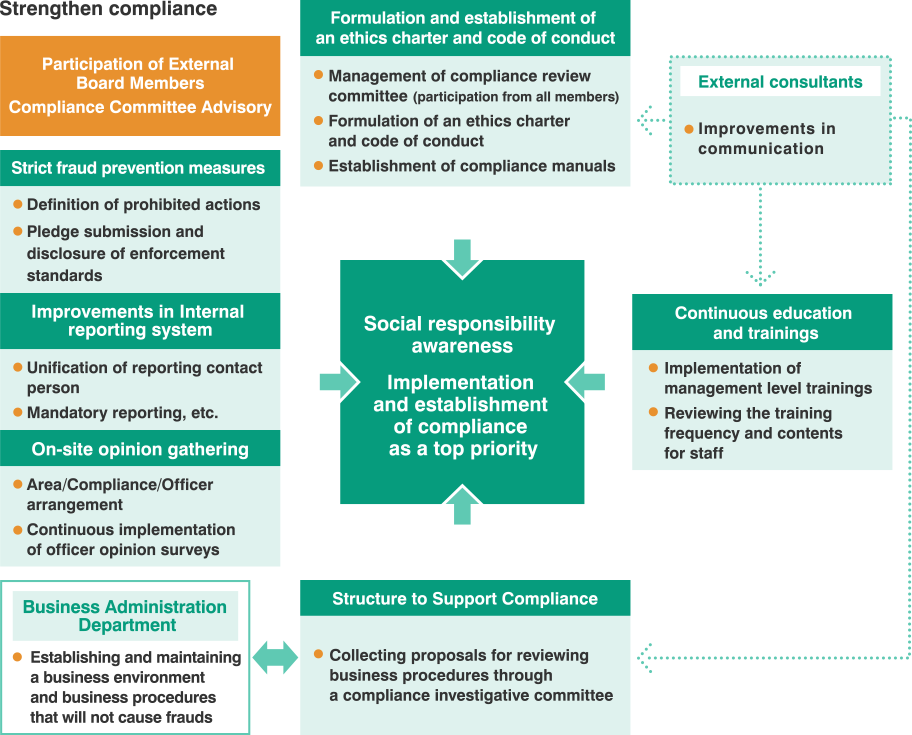

- Towards an organization where compliance is the highest priority.

KPI Items

| Items | Contents | FY 2019 | FY 2020 | FY 2021 Forecast |

|

|---|---|---|---|---|---|

| Business Prospects Evaluation | Number of clients sharing the bank's business model | 65,112 | - | - | |

| Number of clients who has knowledge of the Bank's normal working capital through business prospects evaluation | 61,913 | - | - | ||

| Number of challenges and needs shared with customers | 89,426 | 106,532 | - | ||

| Number of local benchmark initiatives | 33,790 | 39,692 | - | ||

| Unsecured loan ratio based on "Guidelines for Management Guarantee" | 41.2% | 84.3% | - | ||

| Solutions Provision (Core Business Support) | Number of Business succession support projects | 308 | 193 | - | |

| Number of M&A support projects | 20 | 21 | - | ||

| Number of Business matching support projects | 615 | 607 | - | ||

| Number of overseas creditors | 1,090 | 1,041 | - | ||

| Number of cases in which overseas expansion needs are identified | 2,748 | 2,010 | - | ||

| Number of meetings held by Association Secretary General | 160 | 35 | - | ||

| lSolutions Provision (Finance Support) | Zone A | Number of initiatives | 16,474 | 13,725 | 4,000 |

| Initiative funding | 1,477.9 billion yen | 1,303.6 billion yen | 400.0 billion yen | ||

| Loan balance | 907.4 billion yen | 975.8 billion yen | 1,600.0 billion yen | ||

| Zone B | Planning support | 1,185 | 1,651 | 2,150 | |

| Refinance | 1,213 | 1,541 | 1,400 | ||

| Number/ratio of Rank ups | 544 / 13.5% | 418 / 7.7% | - | ||

| Management index improvement status | 2,575 / 76.0% | 2,354 / 68.4% | - | ||

| Loan balance | 938.4 billion yen | 1,029.7 billion yen | 960.0 billion yen | ||

| Zone C | Number of initiatives | 568 | 493 | 750 | |

| Initiative funding | 98.5 billion yen | 134.3 billion yen | 75.0 billion yen | ||

| Loan balance | 166.8 billion yen(*)

|

264.0 billion yen (*)

|

350.0 billion yen | ||

| Zone D | Number of initiatives | 1,048 | 742 | 800 | |

| Initiative funding | 37.9 billion yen | 33.8 billion yen | 40.0 billion yen | ||

| Loan balance | 58.5 billion yen | 61.5 billion yen | 200.0 billion yen | ||

| System / Human resources | Number of visits to the bank (Management Solutions Division) | 5,292 | 3,614 | - | |

| Percentage of obtaining external qualifications for Business Prospects Evaluation | 75.1% | 90.2% | 80.0% | ||

| Percentage of obtaining external qualifications for Business successions | 71.1% | 84.8% | 80.0% | ||

| Number of employees obtaining internal qualifications (Solutions) | 134 | 146 | 130 | ||

| Number of employees obtaining internal qualifications (Management Improvement) | 102 | 117 | 80 | ||

| Cooperation/collaboration with regional financial institutions | Number of visits to regional financial institutions | 1,458 | 1,001 | - | |

| Number of idea exchange meetings with industry associations | 7 | 3 | - | ||

| Number of instances of cooperation and collaborations (Solutions Provision) | 583 | 438 | - | ||

| Number of cooperative loans | 2,160 | 1,549 | - | ||

| Income/expense situation | OHR | 72% | 69% | Approx. 60% | |

| Operating income | 20.5 billion yen | 7.6 billion yen | Approx. 25.0 billion yen | ||

| Outcome (CF improvements) | Number of business CF improvements | 502 | 980 | - | |

| Number of financial CF improvements | 7,825 | 8,812 | - | ||

| Outcome (Reduced credit costs) | Below fear of bankruptcy ⇒ Above attention required level | ▲5.3 billion yen | ▲1.3 billion yen | - | |

| Clients at Attention required level ⇒ Regular clients | ▲2.9 billion yen | ▲1.5 billion yen | - | ||